To be a successful fisherman, you must fish where the fish are. Like fishing, marketing for your business really boils down to finding your fish and telling them about what you offer.

In many fields, especially in the B2C world, meeting your customers where they are is the most effective way to engage and communicate with them. And if you haven’t figured it out yet, your customers are on their phones. They use them multiple times throughout the day and already pay for things with peer to peer payment apps, company-issued payment apps, mobile banking apps, and digital wallets.Are you accepting mobile payments? Here are some reasons why you should.

The Mobile Payment Market

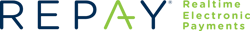

This Statista chart shows the approximate value of all mobile payment transactions in the U.S. In 2018, mobile transactions were valued at $78 billion (up 59% from 2017) and are projected to reach $113 billion in 2019.

The mobile payment market is huge and growing very quickly. Do you have a mobile presence? Are you making it easy for your customers to find you and pay you?

Peer to Peer Payment Apps

Zelle, a peer to peer (p2p) payment service owned by seven banks, has 27 million users. Zelle is a digital wallet and payments platform where you use your bank account to

complete peer to peer payment transactions. Venmo, owned by Paypal, also works

as a digital wallet for initiating and receiving peer to peer payments. Square Cash, the 3rd largest mobile p2p payments platform, has 9.5 million users, according to eMarketer.

These top three platforms had 60 million users in 2018. Even if one-third of these users use more than one of the three platforms (and it’s probably much less than one-third), there is still a market of 40 million users (or 1 in 8 Americans).

With a projected 44% growth rate to $113 billion in transactions and at least 40 million users, the mobile payments market is just too big to ignore.

Company-Issued Payment Apps

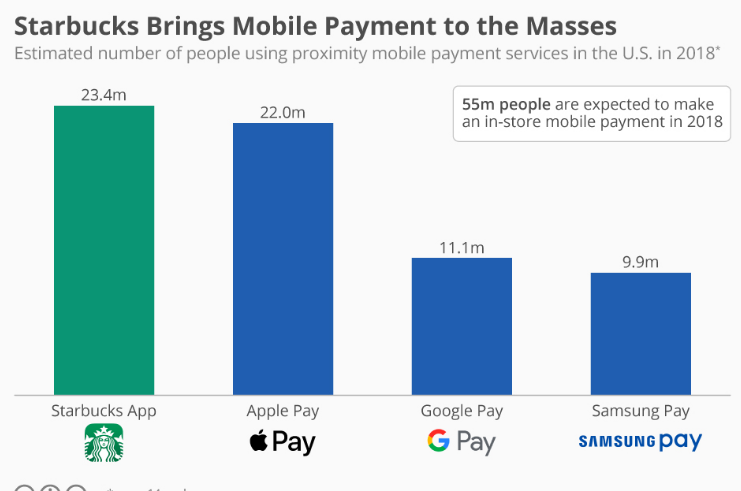

Thanks in large part to company-issued payment apps, consumers are now expecting a mobile presence from all the brands with which they interact. We’ve said before that the most popular payment app is the Starbucks app. There are many reasons why, including:

- the thousands of locations worldwide

- the app’s user-friendly experience, and

- the unique benefits offered, like special features or in-app

discounts

The chart below shows that digital wallets Apple Pay, Google Pay and Samsung Pay, are all popular with a combined total of 40 million users. Yet individually, they each have fewer users than the Starbucks app.

Mobile Banking Apps

Mobile banking apps are much more popular than many people realize. Finextra reports that in a 2018 study, nearly half of the respondents had increased their mobile banking app usage and 31% said they use their mobile banking apps the most. A mobile

banking app is the 3rd most popular app on a smartphone, right after social media and weather apps.

Bankrate reports that 63% of all smartphone users have downloaded a financial app. The U.S. has approximately 250 million smartphones, which means 157.5 million people have financial mobile apps on their phones.

Paypal

Paypal is so big and so old in fintech, it predates the term of ‘digital wallet’ or ‘e-wallet’ and gets its own category. As of Q4 2018, Paypal had 254 million active accounts and 17 million merchants worldwide. It processed 7.6 billion transactions in 2017. Paypal is so popular and trusted throughout the world, that the average account does 35 transactions through Paypal each year. In fact, if Paypal were a bank, it would be the 21st largest bank in the U.S.

Paypal is still growing at an excellent rate. Payments processed grew 25% from 2016 to 2017. If there is room for Paypal to continue to grow, then there is room for you in mobile payments.

Conclusion

When you offer a mobile payment option, you are where your customers are. By making it easier for customers to pay, you will receive more payments earlier and on time. People are already paying bills, splitting their bar tabs, and managing their bank accounts through their phones. Any little piece of the mobile payment market you can claim is added growth for you and convenience for your customers.

If you want to learn more about how to add a mobile payment option for your business, contact REPAY today. One of our mobile payment experts will show you exactly how it works and what it can do for your business.